SVB reported bankruptcy after a huge depositor withdrawals done digitally

[Photo Credit: Seoyeon.Lee]

Silicon Valley Bank (SVB), which took 40 years to develop into a large Silicon Valley brokerage, reported bankruptcy in just 36 hours on March 17, 2023 due to a surge in depositor withdrawals digitally.

Shortly before the actual bankruptcy, SVB had announced that a drop in deposits forced it to sell AFSs (Alternative Financial Services) meaning the bonds and stocks purchased with the intention of selling before maturity, mainly U.S. government bonds, which triggered the SVB’s Bankrun's massive loss; $1.8 billion.

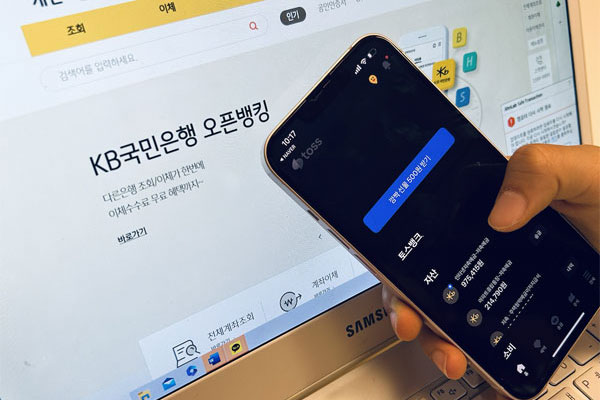

News of a mixture of facts and fiction rapidly spread over social media, causing many people to be aware of this, and a bank run occurred just by opening a smartphone banking app and tapping the number a few times while terrified startup officials responded immediately.

The Wall Street Journal published an article titled "Silicon Valley has been hit by the system created by Silicon Valley," pointing to changes in digital banking operations caused by telephone banking and social media.

Many researchers stress the point that digital banking, digital messaging and social media are responsible for this fast-paced bankruptcy.

"It wasn't a bank operation, it was a phone bank operation, and social media played a central role," Michael Immerman, professor at the University of California's Paul Meraj School of Business, pointed out.

He also said that , "This proves that online banks are replacing offline banks these days … Instead of spending a lot of time at banks to do financial work, it has become possible for people to easily and quickly deposit and withdraw money through mobile phones or PCs.", stressing the point that people nowadays use online banking rather than offline banks.

The background of the incident is the root of growing concern over deposit loss by depositors who have spread to the virus area faster than bank employees or regulators can successfully respond, and the spread of anxiety on SNS and social media.

Sam Altman, CEO of Open AI, said on twitter, "The pace of the world has changed. Things can be solved quickly. People talk fast. People move money quickly."

In response to the criticism regarding the U.S. financial industry’s negligence in preparing for smartphone bank runs, Bloomberg reported that it is "not ready to respond to bank runs that occur immediately through digital viral (rumors)."

In addition, critics point out that South Korea, one of the countries with the highest smartphone usage rate and mobile banking infrastructure, is also relatively exposed to such a "phone bank run" risk.

According to the financial sector on the 16th, the use of deposit and withdrawal services through Internet banking in Korea last year was an overwhelming rate of 77.7%.

Moreover, 5.5% of windows, 14.2% of automated equipment (CD·ATM) and 2.6% of telebanking were calculated.

Some emphasize the need for new measures to prevent bankruptcy in a short period of time as the domestic banking industry has become commonplace in Internet banking.

In particular, there are growing calls for special attention as mobile banking convenience has competitively increased with the advent of Internet banks.

- Esther Lee / Year 8

- North London Collegiate School Jeju

![THE HERALD STUDENT REPORTERS [US]](/assets/images/logo_student_us.png)

![THE HERALD STUDENT REPORTERS [Canada]](/assets/images/logo_student_ca.png)